Determining a New Employees Superannuation Fund - 3 Steps

Employers are required to pay superannuation (super) contributions into an eligible employee’s super fund.

For more information on which employees are eligible to be paid super, see Tax & superannuation. https://www.fairwork.gov.au/pay-and-wages/tax-and-superannuation.

Follow the below steps to determine a new employee’s super fund when they start employment.

The requirement is on the employer to ensure that you have paid all the required super by the 28th of the month following each calendar quarter. The requirement is that the payment must be made in time so that it makes it to the employees super account by this date. In many cases, you need to pay at least a week before to satisfy payment by the due date. Payroll software such as Xero will notify you of the last date for payment to make this date.

ATO Super Deadlines

If the superannuation has not been paid and received by the due date, Super Guarantee Charge will apply and the payment will not be tax deductible. The Super Guarantee Charge is currently $20 admin fee per employee per quarter plus 10% interest up until the date you lodge the super guarantee charge form (not up to when you pay the amount)

Step 1: Employee chooses a fund

Most employees are eligible to choose their own super fund. If an eligible employee chooses a super fund, the employer must pay super contributions into this fund. Information about which employees can choose their own super fund is available from the Australian Taxation Office.

Employers must provide each employee a Super Choice Form when they begin employment which advises the employee what the employer’s default fund is and asks the employee their superannuation fund details.

https://www.ato.gov.au/business/super-for-employers/setting-up-super-for-your-business/offer-employees-a-choice-of-super-fund/

Step 2: Check for a stapled super fund if no fund is chosen

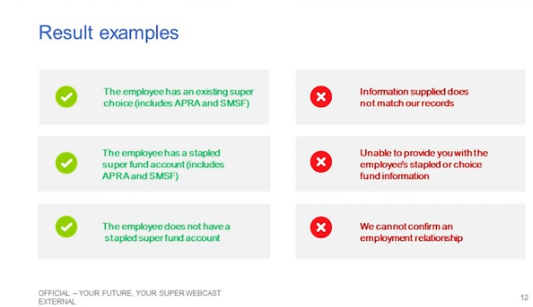

If a new employee doesn’t choose a fund, the employer is required to check if the employee already has a fund by contacting the Australian Taxation Office. An employer should pay into a stapled super fund if one exists, even if that fund is not listed in an applicable award or enterprise agreement.

You can request this information via this form: https://www.ato.gov.au/Business/Super-for-employers/Setting-up-super-for-your-business/Offer-employees-a-choice-of-super-fund/Request-stapled-super-fund-details-for-employees/

An employer has 28 days to provide them with a standard choice form. If a super fund already exists for the employee, the employer is required to pay super into this account, which is known as a 'stapled super fund'. If a ‘stapled fund’ is not found, their contributions will go into the employers nominated default fund.

A ‘stapled super’ fund is an existing super account linked or stapled, to an individual employee so it follows them as they change jobs. This aims to reduce account fees, avoiding new super accounts being opened every time an employee starts a new job.

If an employee chooses a super fund after you have requested stapled super fund details, an employer has 2 months to start paying contributions into that fund. Any payments you make prior to using the chosen fund must be in accordance with the stapled super fund response.

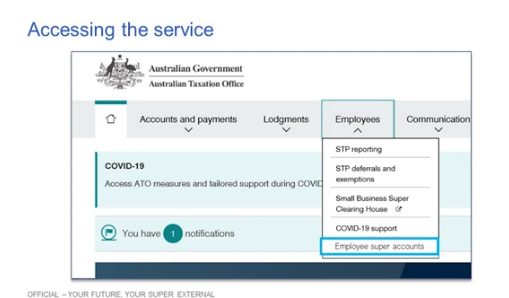

Steps in requesting stapled super fund details: The employer or your authorised representative can request stapled fund details using ATO online services.

- They need full access in the ATO services or customer access that including the ‘Employee Commencement Form’ permission.

- Their ‘Employee Commencement Form’ permission is removed when no longer needed, to protect your employees’ personal information.

Tax practitioners such as Evolve are also able to make a request on your behalf through online services for agents. You need to meet the same requirements when using payroll software to request stapled super fund details.

The steps to do this including navigate to ATO online under the Employees tab. Click on Employee Super accounts. Select request from the Request employee fund screen. Enter TFN number. Select declaration and then you are sent to default screen to show the details of employee super accounts. A bulk option is available if required for >100 employees.

Step 3: Pay into your nominated default fund

If there’s no employee chosen fund or stapled super fund the employer must then pay super contributions into their nominated default fund. According to ATO rules, every employer is obliged to make super guarantee payments on behalf of eligible employees, and the default fund is where those payments will go unless an employee has a nominated super fund.

A default super fund, also known as an employer, nominated fund, is the superannuation fund into which your employer will make your super contributions if you do not nominate a fund of your choosing.

Default funds are intended to be simple low fee options.

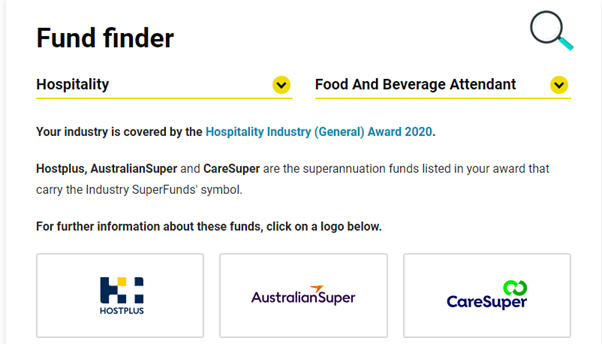

Employers should check their modern award or enterprise agreement for extra rules about default funds. Most awards set out a list of super funds from which an employer is required to nominate a default fund.

An employer can select any industry or retail super fund as their default, but their fund of choice must offer a MySuper account. For employees that do not take an active interest in their super, the MySuper system is designed to ensure that the employer’s default fund will be an appropriate place for their retirement savings.

An employer needs to work through the above three steps in determining the type of super fund. Issue all new employees with a new starter super form or Superannuation Standard Choice Form. If by the end of the quarter the employee has not provided their super fund details, then you are required to set one up for them to pay their super entitlement into.

There are a number of ways you can achieve this, and they are as follows:

- Setup an employer account with an industry super fund.

- Engage your financial planner for assistance.

- Instruct your accountant to automatically create an account with an agreed industry fund to process the super to prior to the deadline.

Information on Default super funds available is found here by selecting the relevant industry and then the role of the employee.

https://www.industrysuper.com/for-employers/default-fund-finder/ An example shown below on how to look up the relevant information.

All new clients to Evolve will be requested to provide the above information as part of the onboarding process and the industry fund details to be included on the job.

QUICK LINKS

CONTACT US

Privacy | Terms of Service | Evolve Online Bookkeeping © 2020 All rights reserved | site by mulcahy.com.au/marketing