What is new in Xero - Tap to Pay and How to Benefit

In this fast -paced world of business, staying ahead of technological advancements is crucial for maintaining efficiency and competitiveness. One of the biggest challenges for small business is getting paid on time when 50% of small businesses are paid late.

How it works and the Benefits

Accept payments on the spot

Spend less time chasing payments and time managing cashflow. This means shorter waiting times for clients and improved customer satisfaction due to ease of the process.

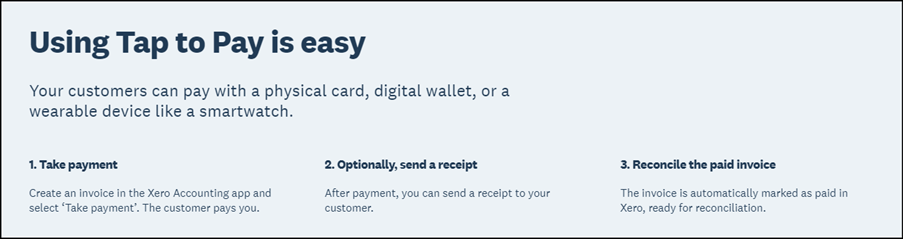

Xero has released a groundbreaking new feature “Tap to Pay”. This is a new innovative secure way to get paid by your customers in-person. You can accept payments on the spot on completion of a job.

All you need is a smart phone, Stripe account and the Xero Accounting application. No physical terminal is needed. This is a great application to assist with getting paid on time in these challenging economic times and enhance your cash flow.

Improved Cash Flow

Receive payments via Stripe using the Xero Accounting app on your mobile with faster payment processing times leading to quicker receipt of funds. Payments can be processed immediately. This is especially beneficial for business with tight cash flow where every day a payment is outstanding can really matter.

This feature can significantly improve a business’s cash flow. This enables better financial planning and management, helping businesses stay on top of their financial obligations.

Simplified Payment Processing

Invoices are automatically marked as paid, ready for reconciliation. This eliminates the need for manual entry of payment data. No need to log into another application or integrate another application. Payments are processed in real-time, ensuring the financial records are always up to date.

“Tap to Pay” integrates seamlessly with existing Xero features, providing a cohesive and comprehensive accounting solution. The ability to easily track payments, generate reports, and manage financial data all within Xero.

This reduces the time spent on manual reconciliations and allows yourself, bookkeeper or accountant more time to focus on strategic financial tasks.

Who is Tap to Pay available to?

Tap to Pay is available to all customers using an Android phone at this stage. There are plans to roll out to other mobile services in the future.

There are some restrictions as presently physical debit and credit cards can only be used for transactions under $100 as PIN verification for amounts greater than $100 is not yet available. Transactions over $100 can still be processed using a digital wallet or wearable device.

What are the fees?

Tap to Pay is free to set up, with no ongoing monthly or subscription fees. There is, however, a processing fee once a customer makes payment.

The fees are 1.7% + A$0.25 per transaction for domestic cards (inc. GST), and 3.5% + A$0.25 per transaction for international cards.

What is required to use Tap to Pay?

Xero is launching Tap to Pay in partnership with Stripe, so you’ll need a Stripe account and the Xero Accounting app on your mobile phone. Both Stripe and the Xero Accounting app are free to download and easy to set up.

Tap to Pay isn't currently available for users with multiple Stripe accounts connected to their organisation. Tap to Pay is only available to use along with Stripe.

Tap to Pay is available with the following Android devices, as long as the operating system is Android 11 and above: Google Pixel, Samsung Galaxy, Oppo, OnePlus, Xiaomi.

Tap to Pay supports payments made using physical cards, a digital wallet or wearable device. Physical debit and credit cards can only be used for transactions under $100 as PIN verification for amounts over $100 is not yet available. Transactions over $100 can still be processed if a digital wallet or wearable device is used for payment.

Tap to Pay needs an internet connection to work. It could be a mobile signal or wi-fi. Tap to Pay will not work offline.

What industries is Tap to Pay suitable for?

Tap to Pay is a great option for small business owners who invoice customers and accept in-person payments, for example, those working in construction, retail or professional services. Examples include tradespeople who do house visits and can collect payment on site; fitness instructors who are off site and need to take payment at the end of class; and hair stylists who need a backup solution for their usual point-of-sale system. Any business on the go.

Also, it is very beneficial for businesses with high customer turnover, such as retail stores and restaurants.

How Evolve Online Bookkeeping Can Help

Evolve Online Bookkeeping can assist you in seamlessly integrating the Tap to Pay feature into your business operations. Our services include:

- Setup and Integration: We help you set up your Stripe account and integrate it with the Xero Accounting app, ensuring everything is configured correctly.

- Training and Support: We provide training for you and your staff on how to use Tap to Pay effectively, ensuring you can take full advantage of this feature.

- Ongoing Bookkeeping Services: Our team can manage your financial records, ensuring all payments are accurately recorded and reconciled in real-time.

- Cash Flow Management: We offer expert reporting to help you manage your cash flow, to make informed financial decisions and maintain a healthy cash flow.

- Customized Solutions: We tailor our services to meet the specific needs of your business, ensuring you get the most out of Xero’s features.

By partnering with Evolve Online Bookkeeping, you’ll not only enhance your financial management but also improve customer satisfaction.

To learn more contact us at Evolve Online Bookkeeping.

QUICK LINKS

CONTACT US

Privacy | Terms of Service | Evolve Online Bookkeeping © 2020 All rights reserved | site by mulcahy.com.au/marketing