Keeping on top of Superannuation changes as an employer in 2023

We are now almost half-way through the calendar year and near the end of the financial year. It is so important to set your business up for compliance changes and get the support you need to navigate these changes. It can be a challenge for any business to stay on top of changing superannuation obligations that are mandated by legislation.

As an employer and business owner you have an obligation to pay the superannuation guarantee. Staying compliant isn’t just a legal obligation, it’s a must for protecting your brand reputation from claims of dodgy super practices.

The Superannuation Guarantee is again increasing 1July 2023

The 2023 superannuation changes are here, starting with the Superannuation Guarantee. This is where the employer must pay a minimum amount to eligible workers with failure to comply resulting in hefty penalties. Businesses faced an increase to 10.5% Superannuation Guarantee on an employee’s ordinary time earnings on 1 July 2022 and that rate is set to increase again.

The Superannuation Guarantee is again set to increase by 0.5% every 1 July until it reaches 12% on 1 July 2025. The year 2021 marked the first increase of super contributions since 2014. Effective for FY24 1 July 2023 the Super Guarantee charge will be 11%.

Compliance is Key

Among other changes to superannuation in July 2022 was the removal of the $450 minimum income threshold for the Super Guarantee. Casual staff or staff working shorter shifts are now entitled to Superannuation Guarantee contributions, which can create a greater burden for small businesses. The changes come at a challenging time for many Australian businesses having faced ongoing natural disasters and a global pandemic over the past few years, against rising inflation, interest rates and supply chain demands.

Business owners cannot afford the consequence of failing a Super Guarantee audit. Good accounting advice and a quality bookkeeping service is crucial to assist with managing your cashflow and auditing your existing payroll and accounting systems in the leading up to and post 1 July 2023.

Getting it wrong can be costly

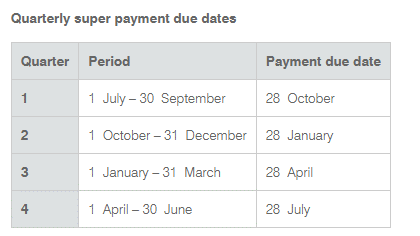

Failure to make your Super Guarantee payments by the due dates can be extremely costly. Typically, the superannuation contributions are to be paid within 28 days of the end of the quarter. Failure to make this payment on time means the employer will be liable to pay the Superannuation Guarantee Charge (SGC), which can be financially punitive, particularly when a Superannuation Guarantee Charge (SGC) underpayment perpetuates over several quarters.

Payment of the Superannuation Guarantee Charge (SGC) is facilitated through the preparation and lodgement of Superannuation Guarantee (SGC) statements, which can cost administratively. There is also a $20 administrative fee payable per individual, per quarter. If a SG underpayment is not rectified before an audit commences, a hefty penalty up to 200% of the Superannuation Guarantee Charge (SGC) can apply.

This is not a list you want to be a part of. The impact to the brand reputation can last for years when workers are left being owed thousands in superannuation and wages.

Contractors and Superannuation

There are also changes to contractors and superannuation. If you are a contractor tasked to do paid work for a business, then you may be entitled to receive the statutory superannuation guarantee contribution to your super fund.

But it all depends on how you are engaged as a contractor, as determined by the Australian Taxation Office (ATO). The ATO says the difference between an employee and a contractor is that an employee works in a business and is part of that business, whereas a contractor runs their own business. So it is possible for someone to be a contractor under the ATO’s definition and still be eligible to receive Super Guarantee SG payments.

A contractor who is paid wholly or principally for their labour may be considered an employee for superannuation purposes. That means they are entitled to mandatory superannuation contributions from their principal contractor to be paid into their chosen super fund.

Difference between an employee and contractor

To get Superannuation Guarantee (SG) contributions as a contractor, the ATO says you must work as an individual, not part of a company, trust, or partnership.

The ATO provides an example of Harry’s Hobby Shop that contracts Pete’s Paints to paint the shop, and the entire job is carried out by one painter working for Pete’s Paints.

As the contract is between Harry’s Hobby Shop and Pete’s Paints, the shop is not responsible for any superannuation guarantee to the painter. Pete’s Paints may have superannuation guarantee obligations to the painter, depending on whether they were an employee or a contractor for SG purposes.

If that all sounds complicated, then the ATO says there are six key factors that separate an employee from a contractor.

- Classifying your worker

- Superannuation obligations still may apply to certain contractors

- Some workers are always employees

- Companies, trusts, and partnerships are always contractors

- Labour hire or on-hire arrangements

- Hiring individuals

To further help determine whether you are considered an employee or a contractor the ATO has an online decision tool. It takes you step-by-step through a series of questions to determine the status for tax and superannuation purposes.

The ATO says this tool is only a guide and if you are still unsure at the end you should seek good accounting advice.

If superannuation guarantee (SG) is still to be applied and the usual superannuation guarantee eligibility rules still apply, which includes earning at least $450 a month.

Sham contracting

Some businesses may tell a worker they are engaged as a contractor when they should be regarded as an employee. The Fair Work Ombudsman says this is known as sham contracting and is illegal. This undermines a workers rights and entitlements.

“Unfortunately, it is becoming an increasingly common practice for many businesses to engage workers as independent contractors to avoid paying entitlements such as superannuation and leave, when workers should in fact be hired as employees,” she said. “Sometimes, sham contracting occurs recklessly or deliberately by an employer.”

Courts can impose hefty penalties on businesses or individuals for sham contracting.

Make 2023 the Year of Compliance

The Federal government has previously flagged a proposal to take non-super-paying employers to court. Being compliant for 2023 superannuation changes might have you feeling a little overwhelmed and all business owners have ample on their plate.

Additionally, if you think you have incorrectly engaged an employee as a contractor, follow through using the steps on the ATO portal using the decision tool and obtain good independent accounting advice.

If you need assistance with any of the above please do not hesitate to contact us on 07 5413 9393 or enquiry@evolveonlinebookkeeping.com.au

QUICK LINKS

CONTACT US

Privacy | Terms of Service | Evolve Online Bookkeeping © 2020 All rights reserved | site by mulcahy.com.au/marketing